Globalization is not a new concept. It is old news now that an event in one country impacts every single country in the globe. It is important to understand consumer behavior across international borders, because this globalization comes with a lot of challenges.

But it also means that consumers of your products are spread worldwide. Their tastes and preferences, values, perceptions, and everything else would be dynamic.

Marketing would also have to be globalized. The one size fits all principle no longer applies to marketing. It does not even apply to products and services.

Studying consumer behavior across international borders has become increasingly important as globalization has sunken its claws deeper into the world economy.

The instant noodles you like eating as a consumer in India would be very different from the preferences of someone living in Korea. They would be even more different than someone living in South Africa.

We have already studied the cultural, social, personal, and psychological factors that influence and shape consumer behavior (click here to read these chapters). It is obvious that consumer behavior across international borders would be very different based on how these factors vary, especially cultural and social factors.

Personal and psychological factors may not play such a significant role when it comes to studying consumer behavior across international borders because these factors vary vastly even within the same geographic region.

In this chapter, we will see how consumer behavior varies in three regions - India, Europe, and America.

Indian consumer behavior

The first, and possibly the most important, region to be analyzed by Indian firms while studying consumer behavior across international borders is India itself. While India is a large market, it is still growing larger and is home to more than a billion people, all with different tastes and preferences.

This section will try to analyze consumer behavior trends in India in an attempt to differentiate consumer behavior across international borders. While reading this section, try to identify which consumer behavior trends you follow as an Indian consumer.

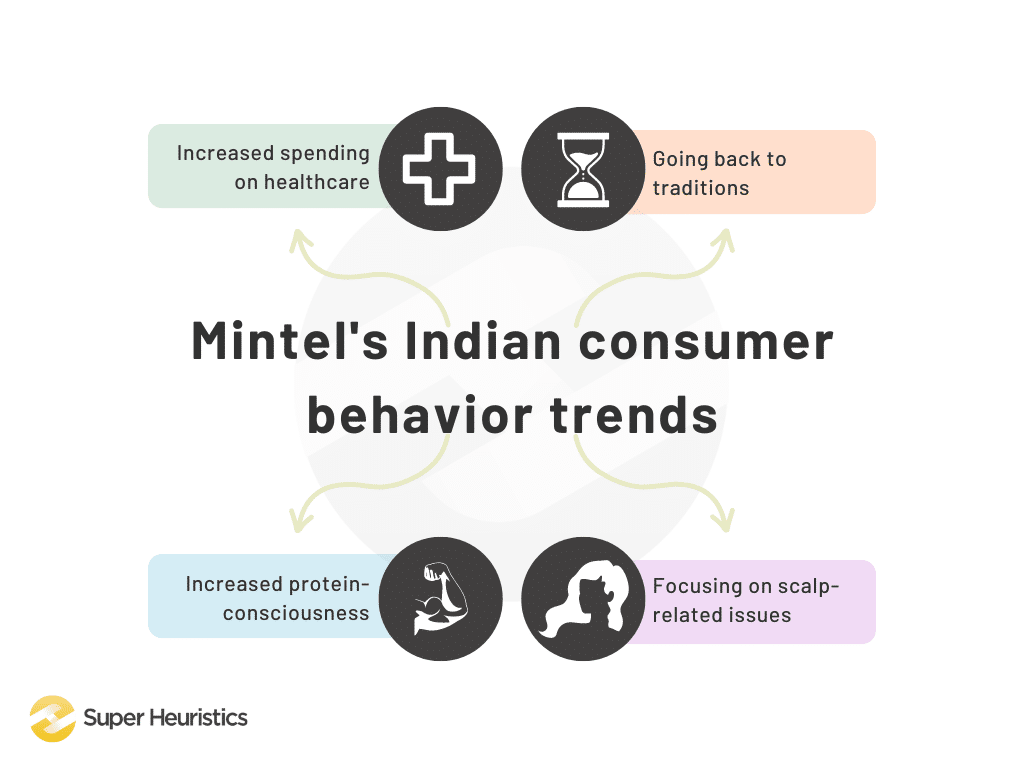

According to a report by Mintel, as late as February 2022, 46% of Indians were worried that COVID-19 would negatively impact economic growth. This led to a significant decline in spending and a similar increase in savings.

We all tightened our wallets after the global pandemic hit in 2020. Jobs were hard to come by, and layoffs were becoming increasingly common. Luxury service businesses, like restaurants and spas, were going out of business not only because of locational disadvantages but also because consumers were spending more on their most basic necessities.

In 2022, 67% of Indians spent more on healthcare than they did a year before that. Indians are becoming more and more conscious about what they purchase now that they know how fickle the world economy is. This is even truer today because the US recession is also leading to multiple layoffs in the biggest firms, including Amazon and Meta (Facebook).

Indians are also going back to their roots and remembering their traditions. 39% of Indians aged 35-44+ expect brands to offer traditional ingredients in packaged formats. This is clear from the increasing popularity of brands like Biotique and Mama Earth.

Indians are becoming more protein-conscious due to combined efforts by the government and the private sector to educate consumers about the lack of protein in their daily diet. It was also seen in the Mintel report that women are more conscious of this protein deficiency than men. The Indian market is still looking for cost-effective, convenient-to-use, and tasty substitutes for foods that contain protein.

Another opportunity for businesses to grab is the hair-care market. Scalp-related issues are on the rise due to increasing climate change adversities, and there are only a few small players who focus on this issue faced by a large market. Businesses can enter the market and grab this amazing opportunity.

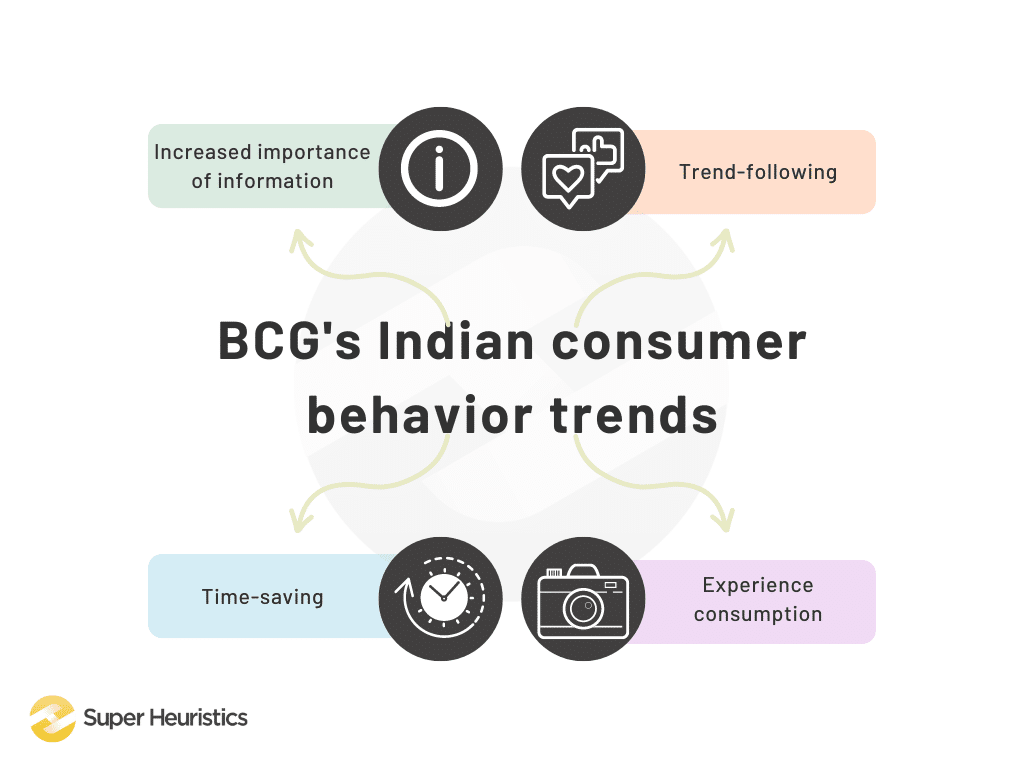

A similar study was conducted by the Boston Consulting Group in 2019. It found that an increasing number of people living in urban India started treating information as an essential variable in their shopping experiences. Information in this sense includes product reviews, nutritional information, expiration dates, comparison with substitutes, etc.

More than 60% of respondents in the survey reported that they tended to purchase some items just because they were in trend, not because they actually needed a replacement or even an upgrade. Most of these trendy products were ones that others could see and notice, like clothes, gadgets, cars, etc.

Indian consumers are also switching to products and services that save time, even if they increase costs. For example, you may be willing to pay extra charges as delivery fees on your groceries if it saves you the time and effort it takes to get your car running, go out to the supermarket, pick out each individual item placed aisles apart, carry it to your car, then drive back.

Almost four-fifths (77%) of the respondents reported that they wanted to consume experiences. The most popularly consumed experience was travel, followed closely by entertainment, at the time the survey was conducted in 2019. Some people even said that they reduced their budget on products to increase their spending on experiences, like buying a massage or traveling instead of buying clothes.

Most of these trends observed by both Mintel and BCG were affected greatly due to the surge in the usage of social media. India has the second largest population of social media users, second only to China, with over 755 million social media users in 2022, according to Statista.

You may have noticed the same thing in your buying patterns as well. Social media has changed the way we all look at products and services, analyze them, and finally even buy them. By adding a personal touch to every single buy, social media has made it easier for businesses to target the exact consumer they want to bait.

For example, while you may skip ads on search engines like YouTube, you have to tap or scroll through the ads on Instagram. Brownie points to the business if you actually wait to see the whole ad and probably buy the product or service being offered as well.

Social media has not only affected Indian consumer behavior but has changed the dynamics of consumer behavior across international borders. Let’s now analyze consumer behavior in Europe.

Consumer behavior in Europe

Europe is home to some of the strongest economies in the world, including Germany and France. Apart from businesses, it is the consumers who actually support an economy by allowing the businesses to keep functioning. Let’s take a look at consumer behavior in Europe to see what trends have gripped the continent.

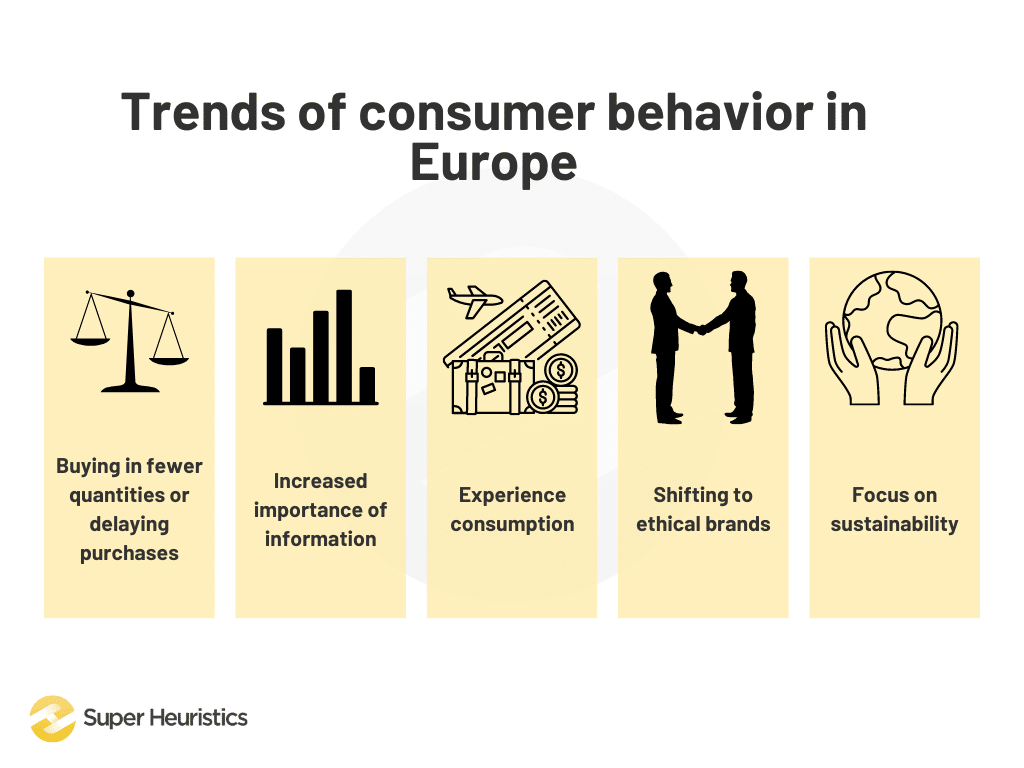

McKinsey & Company conducted a study in 2022 to find out the impact of the Russia-Ukraine war on consumer behavior in Europe. Surveys were conducted in April and had 1000 respondents each from France, Germany, Italy, Spain, and the United Kingdom. Its findings were just as interesting.

Nine out of ten Europeans have a pessimistic view of the economy and perceive that prices are rising, even for basic necessities. Due to this, people are saving more and consuming less, with a higher share of the expenditure getting allotted to basic needs like food, transport, and energy.

People are buying products in fewer quantities or delaying purchases as they did right after the pandemic. Many are even trading down by turning to private labels, discounters, or more affordable brands.

Mintel conducted a webinar in January 2023 to discuss its findings about consumer behavior in Europe in 2022. Due to unpredictable rising prices, consumers felt the need to stay in control. For this, consumers required information about brands and their products to make comparisons and buy what’s best for them.

As late as 2022, consumers were still looking to spend more on experiences like travel, restaurant services, spa services, etc. This was because of the lack of opportunities (and funds) to spend on the same during the lockdown.

Consumers were also interested in finding out what brands had actually done to remedy the controversial issues they spoke up against. Just saying that ‘we support this cause’ is no longer enough as consumers look for measurable outcomes from brands’ campaigns.

Sustainability was also a major concern for consumers as they realized that they can cause businesses to shut down or remedy their actions by not purchasing from them at all. Consumers actively looked for brands whose products and services were certified as sustainable, biodegradable, and environment-friendly.

Clearly, the major worry in Europe is about unpredictable events or events that could be predicted but were not exactly sure to happen. In the case of Europe as well, social media plays a big role, albeit not as big as in the case of India.

In 2022, it was found by the World Economic Forum that 72% of the citizens of countries in the European Union got to know about news online. There is an increasing proportion of people who get their news from social media rather than directly from news apps or websites. In the case of European consumers, social media plays an important role as a news disseminator.

American customers' behavior

USA is considered the most powerful nation in the world. It is only logical to study American customers’ behavior when we talk about analyzing consumer behavior across international borders.

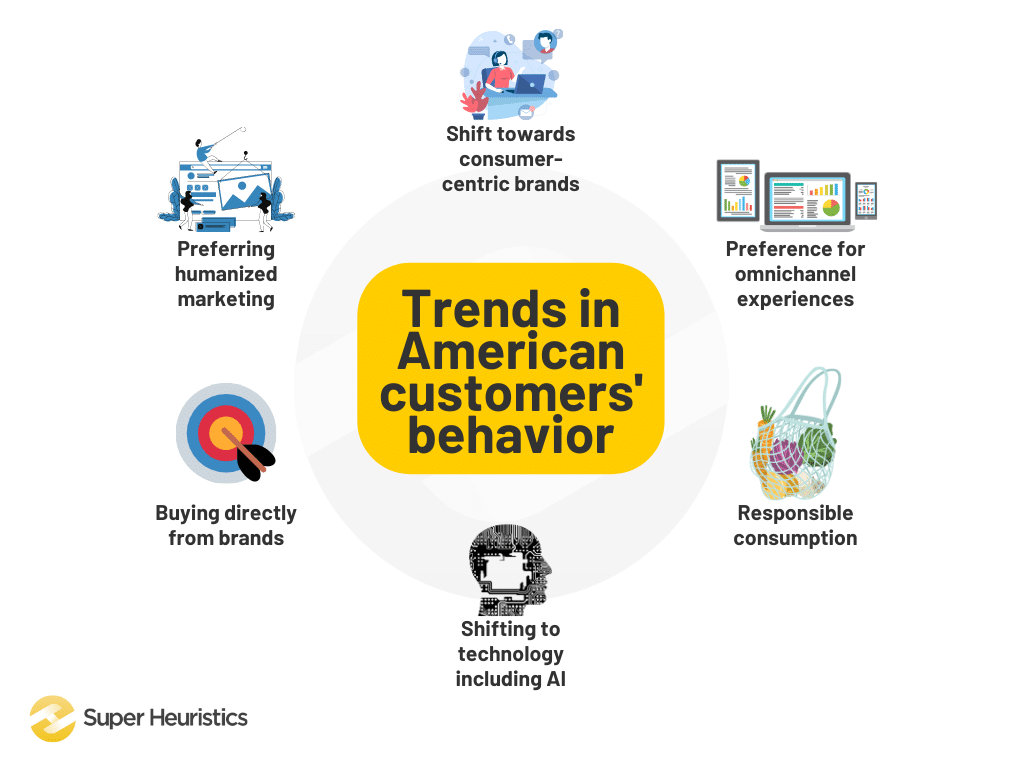

The Keenfolks identified six consumer trends in 2022. The first is that consumers want to shift to consumer-centric brands that focus on their needs and wants, rather than brands that do the advertising, sell their products, and consider their job done. Consumers are looking for awesome customer service, which can only be done by collecting data from consumers, analyzing it, and ultimately using it to the best advantage of the brand.

The second trend is the shift towards omnichannel experiences. Consumers don’t want their shopping experience to be limited to only one device or store. They want a seamless experience where they can interact with the brand on multiple channels.

Another trend is the shift towards responsible consumption. Consumers are realizing that the damage done to the environment is not only caused by businesses but also by consumers who become the revenue makers for these firms. 85% of consumers shifted to sustainable products and services.

60% of consumers completed their first online purchase during the pandemic. The same percentage of consumers also believe that technology is a necessary factor when it comes to customer loyalty and satisfaction. Technology can be used not only for the online shopping experience but also be employed in-store as AI.

60% of consumers wanted to buy directly from the brand. Personalization of service and experience becomes a key differentiating factor here. Consumers can buy directly from brands using their websites or even from their social media accounts if the brand is small.

Consumers have shown a preference for humanized marketing through storytelling. Brands that invest in video marketing have started shifting to storytelling as a marketing tool. This may not increase the conversion rate like a direct advertisement, but it is still a powerful tool to increase brand awareness and improve customer relations.

Again, it is observable that social media plays a crucial role in changing consumer behavior. Once an influencer starts a trend, it is almost impossible to stop people from following them. The number of followers of the influencer directly impacts the size of impact the trend will have on brands’ revenues.

The common denominators in consumer behavior across international borders

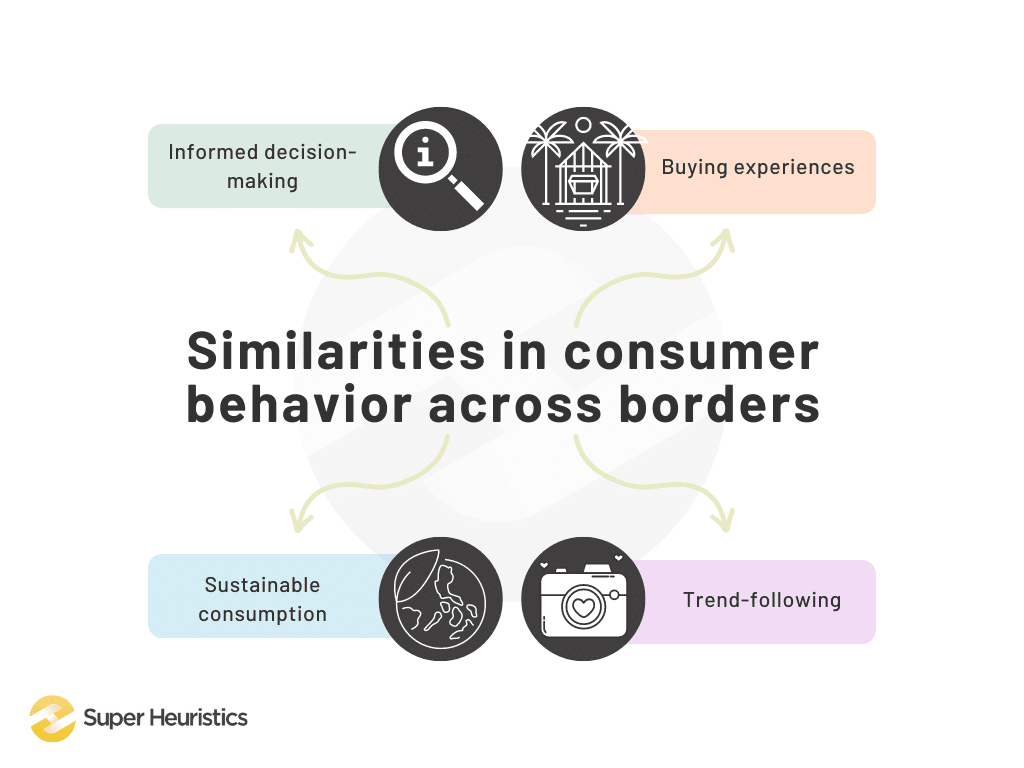

While it is obvious that consumer behavior trends vary across the world, it is also clear that consumers have some common factors when making purchase decisions. Let us look at these factors one by one.

1. Informed decision-making

Consumers around the world are looking for ways to get information about products and services readily. They want to compare the products and services of your brand with those of your competitors to find out which brand they will build a relationship with.

This is great news for your brand if you do not hide information from your customers. Transparency is key, and so is honesty. Be honest not only in your dealings but also in your disclosures.

Make sure that your firm’s website is regularly updated to present only the latest information. All information regarding your certifications, claims, etc., should be readily and freely accessible to all.

2. Buying experiences

The COVID-19 pandemic has left such a lasting impact on the world that even after almost three years, consumers are still recovering from social isolation. The travel and restaurant industries are here to gain from this, probably in the long run.

Products and services come and go, but experiences last a lifetime. This mantra has been adopted by consumers across the globe. The hospitality industry is more than happy to oblige.

The best experience a consumer can buy is travel. Seeing a new place, interacting with its people, and experiencing its culture - these are all the factors that lure people into spending huge sums of money on travel.

However, firms selling products should not be demotivated. If you can market your product as an experience in itself, you can gain from this shift too! For example, the Red Bull Stratos jump marketing campaign was a huge hit. Check out their video here.

3. Sustainable consumption

Consumers are taking more responsibility for climate change action, and so should your brand. People are becoming more conscious about what they consume and how it affects the environment. It is in the best interest of businesses to adopt sustainable practices if they haven’t already.

Sustainability does not only mean biodegradable products. It also means natural packaging, zero to low waste processes, zero carbon goals, etc. Even if you are a service provider, you can use natural products (oils and creams in the case of spa services) and low-carbon emitting machines.

In the context of India, this could mean switching to traditional products packaged in sustainable materials.

4. Trend-following

Social media users are increasing every single day by huge numbers. This means that an increasing number of consumers are getting informed about trends across the globe.

Trends don’t only include TikTok dances, weird foods, and flashy clothes. They also include locations where most influencers are recording their videos, products and services they are endorsing (paid or unpaid), and viral hacks.

Consumers want to stay relevant, and the best way to do that is to show that they are up to date with the current trends. Brands can get influencers to endorse their products and services, visit their locations, or gain organic popularity among netizens.

Conclusion and key takeaways

While it is clear that consumer behavior across international borders varies widely, it is also clear that some consumer behaviors remain relevant across the globe. To recall, the key takeaways from this chapter are:

- Indian consumer behavior trends include increased spending on healthcare, focus on traditions, more protein-consciousness, increased spending on hair care products for scalp-related issues, the increased importance of information in the decision-making process, trend-following, time-saving, and experience consumption.

- Trends of consumer behavior in Europe included buying products in fewer quantities or delaying purchases, informed decision-making, increased experience consumption, demanding information related to brand ethics, and sustainable consumption.

- Trends in American customers’ behavior included shifting to consumer-centric brands, omnichannel experiences, responsible consumption, shifting to technology including AI, buying directly from brands, and preferring humanized marketing.

- Some common denominators in consumer behavior across international borders include informed decision-making, experience consumption, sustainable consumption, and trend-following.

In the next chapter, we will take a look at the changes in consumer behavior due to the pandemic.