Imagine a firm that deals in ten different businesses. These ten businesses have ten more divisions under them, and each division has 10 brands under them. The firm is dealing with 1000 other brands, and you are asked to make a future strategy of all these brands collectively.

The process seems mind-boggling and confusing at the least. Still, we have firms working in multi-national countries dealing with hundreds of such businesses. So, how does the management make such important decisions?

Such firms use the Boston Consulting Group's portfolio matrix or BCG matrix. We will study the BCG Matrix by taking the example of India's ITC limited, which has a diverse mix of businesses and numerous brands under them.

The BCG matrix of ITC will help us to understand the strategic choices the marketers make. Whether to continue with existing product mix, including new products and how much to invest in the existing ones.

Lets put ourselves into their shoes and understand their process in making decisions using the BCG matrix of ITC.

Why is the BCG Matrix used?

Whether you are setting up your business or having a well-established one, growth is a desirable factor. What measures growth is sometimes your revenues, or sometimes the products offer and often the development of the various products or services.

With increasing sizes in operations, the businesses tend to create Strategic Business Units or SBUs. These SBUs has its own rate of return on investment, growth potential, and associated risks. They are independent of the other SBUs.

Your businesses' critical growth may come from a single brand or a mix of brands. How you'll go about making decisions regarding the future strategy is where the BCG matrix helps us.

Source: thebalance.com

The upper management has to find a balance among these SBUs operations so that the overall organization yields growth and profits with an acceptable level of risks.

Some SBUs generate a large amount of cash, and others need money to foster growth. The challenge is to balance the organization's portfolio of SBUs for best long-term performance.

To determine the portfolio and make informed decisions, managers determine future cash flows and expected growth for every SBU. They then classify the portfolio based on its present or expected growth and market share.

A BCG matrix is created, and it helps the managers to optimize their product portfolio. But the main question is still here- How?

Let's find out, but first, we'll look into the What is a BCG matrix? And then we will create our own ITC BCG matrix.

Marketing Concepts Mastery Course

Learn the essential marketing concepts. Create the best outcomes from MBA without depending on placements!

Understand BCG Matrix, SWOT Analysis, Ansoff Matrix and many other important marketing frameworks just like an expert MBA professional would. Solidify your concepts while building a personal brand in marketing.

What is a BCG Matrix?

Source:superhueristics.com

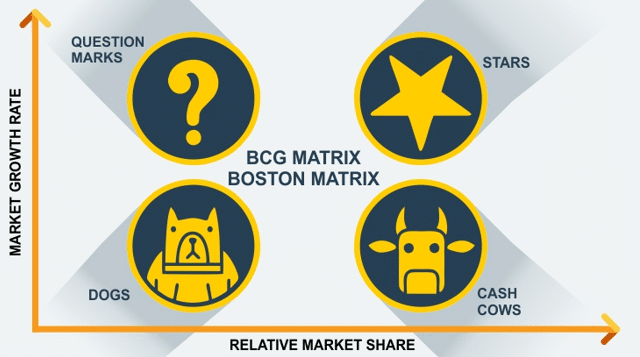

We by now are clear on the concept that BCG matrix contains a product portfolio for a firm. But how is it done? Let's find out.

BCG Matrix uses the SBUs present or expected growth and present market share. The growth numbers are already current or forecasted using proper techniques and channels. The measure of the market share is a relative market share.

The relative market share is the ratio between the company's claim and the largest competitor's share. For example, - If a firm's products market share is 10%, and the largest competitors are 50%, the market share ratio is 0.2 to 1.

These numbers are plotted with a relative market share on x-axis and market growth rate on a y-axis.

The figure represents a typical BCG matrix. The portfolio mix breaks the BCG matrix into four categories based on market share and market growth rate.

Let's learn them in more detail.

Star

A star is a fast-growing market leader. They generally have the largest profits but needs a lot of cash to finance rapidly.

The best strategy is to protect existing market share by reinvesting earnings in product improvement, better distribution, more promotion and production efficiency. Management needs to ensure that its existing consumer base is increasing.

Cash Cows

A Cash Cow produces more cash then it requires to grow and hence, the name. The product is in a low growth market but has a dominant market share.

The best strategy is to maintain the market share by being a price leader and making technological improvements. The excess cash generated can be used by other products in the portfolio where large investments are required.

Question Mark

A Question Mark, also known as a problem child, shows rapid growth but lower profit margins. It has a low market share in a high growth market. It needs a great deal of cash to increase market share.

The strategy is to either use the cash to invest heavily in gaining market share, acquire competitors or drop the SBU at all. Marketers need to make a lot of efforts to make the problem child progress to a star.

Dogs

A Dog has a low market share in a low growth market. Most dogs eventually leave the marketplace.

The strategy is either to divest or harvest. Divesting is the practice of shutting down the SBU. In contrast, harvesting is the practice of cutting back all the investment to maximise profits, even if it loses all market shares.

Let's now move on our firm in focus ITC Ltd and see what ITC BCG matrix is like. But first, we'll look into the Product Mix of ITC.

Product Mix of ITC

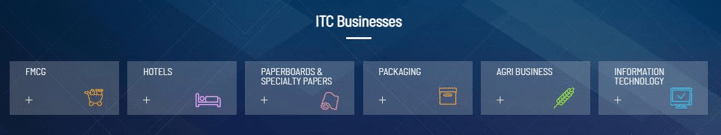

In our example of ITC limited, ITC classifies their businesses into six main categories. These categories are again divided into their individual divisions. These divisions further have numerous brands under them.

Imagine if one asks you to make the future strategy of all these brands one day, how much data and how chaos and confusion can happen. The ITC's senior management uses the BCG matrix of ITC to ensure no brand is left out of the strategy.

Let us start with the first step of our ITC BCG matrix by first analyzing the Product Mix of ITC. ITC classifies their products into six broad categories, they can be seen as:

Source:itcportal.com

FMCG

ITC FMCG products have 25 mother brands with a diverse mix of different businesses.

ITC FMCG products have 7 broad categories: Foods, Personal Care, Education & Stationery, Lifestyle Retailing, Agarbattis, Safety Matches and Cigarettes.

Notable brands in Foods include Sunfeast, Ashirwad, Bingo, Yippee etc. Some personal care brands include: Fiama, Vivel, Dermafique, engage etc. Education and Stationery brands include Classmate and PaperKraft.

Lifestyle Retailing is done under the name of WLS and Agarbattis (Incense Sticks) sold under Mangaldeep. Two brands Aim and Homelite form the matchstick portfolio.

ITC initially started off as a cigarette manufacturer and is the market leader in India. ITC's wide range of brands includes Insignia, India Kings, Classic, Gold Flake, American Club, Navy Cut, Players, Scissors, Capstan, Berkeley, Bristol, Flake, Silk Cut, Duke & Royal.

Source:itcportal.com

Hotels

ITC classifies its hotel properties into four broad categories.

ITC hotels have an exclusive tie-up with Marriott's 'Luxury Collection'. Some of the hotels under this category are- ITC Grand Bharat in Gurugram. ITC Grand Chola in Chennai, ITC Maurya in Delhi, ITC Maratha in Mumbai, etc.

Welcomhotels offers five-star hospitality for travellers. Some of the hotels under this brand are-WelcomhotelDwarka - New Delhi, Welcomhotel Bella Vista - Panchkula-Chandigarh, Welcomhotel Jodhpur - Jodhpur, etc.

Fortune Hotels operates mid-market to upscale properties in the first-class, full-service business hotel segment all over India, in major metros, mini-metros, state capitals and business towns.

WelcomHeritage is a chain of palaces, forts, Havelis and resorts that offers a unique experience.

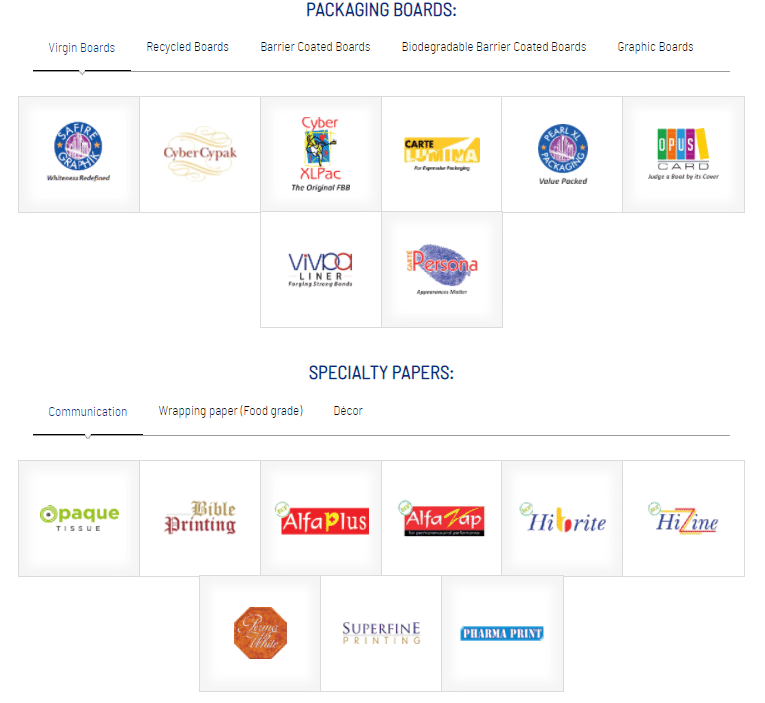

Paperboards & Packaging

ITC paperboards include a wide range of boards like- Virgin boards, Recycled boards, Barrier Coated panels, Biodegradable Barrier Coated boards and Graphic boards sold under various brand names.

ITC specialty papers are sold under broad categories like- Communication, Wrapping Paper(Food grade) and Décor.

ITC packaging paper is sold to its own FMCG units and numerous other national and international companies. The packaging business sells primarily for Carton Board packing, Flexible Packing, Tobacco packing, Innovation and New product packing and Green packing.

Source:itcportal.com

Agri-Business

ITC's Agri-Business is the country's second-largest exporter of agri-products. It currently focuses on exports and domestic trading of Feed Ingredients – Soyameal; Food Grains - Wheat & Wheat Flour, Rice, Pulses, Barley & Maize; Marine Products - Shrimps and Prawns; Processed Fruits - Fruit Purees/Concentrates, IQF/Frozen Fruits, Organic Fruit Products &Coffee.

Information Technology

ITC Infotech is a global technology services and solutions provider, followed by Business and Technology Consulting.

Also Read: 7Ps in the marketing mix

Now, we have looked at the diverse ITC Product mix, let's create the BCG Matrix of ITC. We'll then progress to how to use the ITC BCG matrix and see in detail how future strategic decisions are taken.

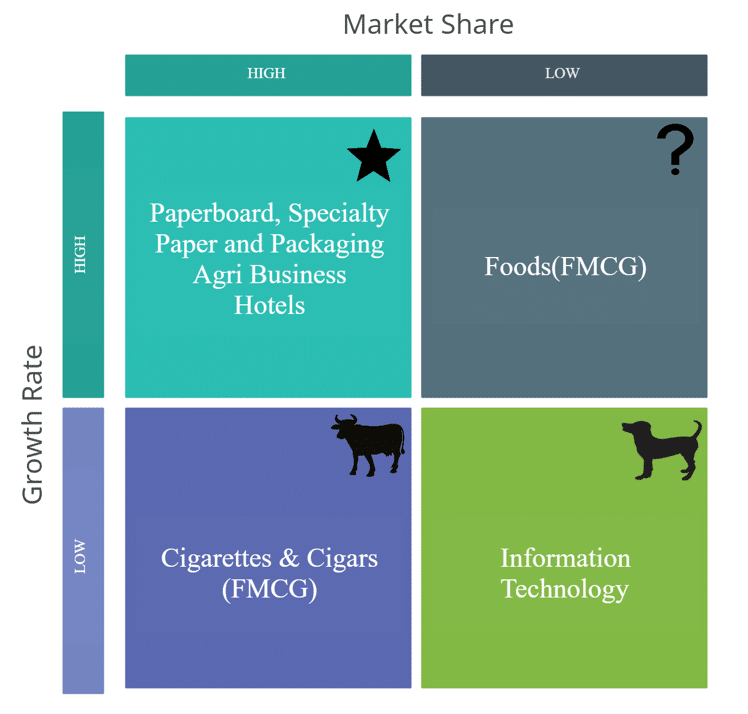

BCG Matrix of ITC

A close study of the expected growth rate and the subsequent market rate will give us the preliminary information for our BCG matrix. As the number of brands is numerous, for simplicity's sake, we will take into consideration the ITC's businesses and will make the BCG matrix of ITC.

Let's have a look at our ITC BCG Matrix.

The BCG matrix of ITC Ltd has divided its key business units into four broad categories. Let's have a look at them one by one.

Star Products

ITC Ltd has three stars: Paperboards, Specialty Paper and Packaging; Hotels and Agri-Business.

Let's find out why first.

The Paperboards and Specialty paper business are India's largest in sales among the paper and paperboards businesses. The industry is slated to grow by 7.8 % CAGR by 2024.

ITC hotels are one of the fastest-growing hospitality chains in India. The hospitality business's growth rate places it in the Star category.

ITC Agri business is among the largest integrated Agri business units and is the country's largest exporter. The Agri business is expected to grow by 10.70% by 2040.

All three businesses have a high growth rate and also has a high market share. This places them in the star category.

They are the fast-growing market leader. They generally have the largest profits but needs a lot of cash to finance rapidly. This means that marketers have to reinvest all their earnings from the stars into promoting the stars.

Cash Cow Products

ITC Cigarette and Cigar business is the market leader in India with its wide range of brands available. It is the leader in every segment of cigarettes and Cigars sold in India. The growth in this sector is expected to be only 3% by 2021 in India.

The Cigarettes and Cigars in the FMCG sector have a high market share. Still, the industry's growth is slow, which means that the product is in a low growth market but has a dominant market share.

Marketers will have to maintain their market share. The excess cash generated can be used by other products in the portfolio where large investments are required. The extra money is usually pumped into brands in question mark category, which has the potential to be a star.

Question Mark Products

ITC foods come under the question mark category, the food industry in the FMCG sector is expected to grow by 23.15% CAGR by 2021. ITC FMCG products, particularly foods, is growing but the growth rate is only 7.3 %.

The product is in a high growth market, but the market share is low. Hence, it's a question mark which means it shows rapid growth but lower profit margins. It needs a great deal of cash to increase market share.

The marketers can either use the cash to invest heavily in gaining market share, acquire competitors or drop the SBU at all. They will need to make a lot of efforts to make the question mark progress to a star.

Dog Products

ITC Information Technology under the brand name ITC Infotech faces immense pressure by competitors like Infosys, TCS, Accenture, HCL. With the entry of international players, the market share is declining.

ITC Infotech has a low market share in a low growth market. As most dogs eventually leave the marketplace, ITC Infotech future existence is questionable here.

The marketers can either divest or harvest the business. Divesting is the practice of shutting down the SBU. In contrast, harvesting is the practice of cutting back all the investment to maximise profits, even if it loses all market shares.

Case Analysis Blueprint Course

Use marketing frameworks like these to solve business case studies with ease

Frameworks like the BCG framework are extremely crucial to analyze the most complex case studies. Get to know how to analyze a marketing case study comprehensively in just 5 slides. Which means that the next time you need to analyze a case, you know exactly how to ace the case

What to do with the BCG Matrix?

After classifying the ITC's SBUs in the Matrix, and obtaining the BCG matrix of ITC, the next step is to allocate future resources to these SBUs to ensure the long-term growth of ITC. Let take a look at how it is done.

The marketers either go with one of the four strategies-

Build

If the firm has a question mark SBU, and it has the potential to be a star, the marketers will build the question mark. The firm leaves its short-term profits and uses financial resources to achieve its goal.

ITC FMCG Products mainly, foods is a question mark. At this time, the firm may want to build the foods sector by investing heavily in marketing activities. This will ensure that the food category market share increases and one day, it can be a star for ITC Ltd.

Hold

If an SBU is a very successful Cash Cow, the firm will hold the market share and look for ways to improve it.

The BCG matrix of ITC has cigarettes and cigars in the Cash Cow category, ITC will hold onto the market share or make technological advances or strengthen its distribution channel to further increase the market share.

Harvest

The strategy is applicable for all SBUs except the ones classified as Stars. The firm focuses on the short term goal by increasing the cash return without too much concern for the future return. It is more favourable for those Cash Cows where the future prospects are not favourable.

ITC can use this strategy for either Cigarettes or Infotech if focusing on the short term goals will help the firm to increase its present cash return.

Divest

Divesting is getting rid of the SBUs with low shares of the low-growth market. This strategy is most suitable for question marks and dogs.

ITC may want to get rid of ITC Infotech at all as it is in a low growth market and faces immense competition from the competitors.

All strategic decisions are taken on the portfolio mix or the BCG matrix. Still, the decision making is not exclusively based on this. Sometimes disruptive innovations in the field can severely affect the marketer's decisions.

Conclusion

We learnt why we need a BCG matrix and What it is. Why it's such an essential tool for marketers.

We created The BCG Matrix of ITC Ltd. We identified the Matrix's various components, namely- Star, Cash Cow, Question Mark and Dog.

We started off by studying the product mix of ITC Ltd and focused on the expected market growth and the market share and then progressed to ITC BCG Matrix.

The Matrix helps us to understand which strategy to use for which category. The strategies that are used by marketers are- Build, Hold, Harvest and Divest.

Great explanation ????