What is the best way to make a definite profit on a product that you are selling?

Simple, calculate the cost of that product to your company, add your profit to it and sell it that that price.

How to make an even bigger profit?

Even simpler. Think of an even bigger number, add it to the cost and that is your new price.

This is cost plus pricing for you. Simple, quick and quite intuitive.

But here’s what the truth is.

Cost Plus Pricing strategy is probably the worst form of pricing strategy that you could go for.

And in this article, I will be showing you all the disadvantages of cost plus pricing.

Therefore, my advice – avoid cost-plus pricing at all costs!

If you are a product manager who prices his/her products using cost-plus pricing, you are likely to deny my advice that cost-plus pricing is bad.

You know why?

Because Cost Plus pricing is a drug! And that’s what drug addicts like you do – deny the fact that the drug is bad.

The fact is, you will deny that Cost Plus Pricing is bad just because all this while cost-plus pricing has given you a false sense of assurance that you are making profits. Just like a drug does.

And also the assurance that the profits are in your control.

“I increase the markup whenever I want more profits. That easy.”

A few weeks back I discussed Cost Plus Pricing where I told you about what it is and what are some of the cases where it is used. I also brought in front of you some of the disadvantages of cost plus pricing.

With whatever I told you about the disadvantages of cost-plus pricing, it was clear that cost-plus pricing strategy isn’t the best pricing strategy at all.

In fact, I shared with you another pricing philosophy, called Value-based Pricing. But I will tell you about that in another article.

[cmtoc_table_of_contents]Let’s get down to understand some of the disadvantages of cost plus pricing. But before that, let’s have a look at two fundamental problems that you as a marketer will face in pricing.

The Overpricing and the Underpricing Problems

Believe it or not. The company where I worked at sometime back – we committed a pricing blunder there.

A blunder which made us decrease one of our product’s price by 80% within just 4 days of launch!

It was crazy!

But that was the corrective action that we took, with a lot of customer bashing.

Whatever I told you above, what does this tell you about Pricing?

One simple thing, I hope. That If your prices are not in sync with your customers, you are doomed for sure.

Also Read: How to Price Your Product – The Fundamentals

If your target segments are not ready to pay what you think is a fair price, you can do nothing to change that fact. The fact is, no matter how differentiated your product maybe, the price will usually have an overriding effect in the buying decision.

Why?

That’s because as human beings we are more averse to a loss than being affinitive towards a gain of the same value.

So, if you are charging too much, you are obviously making a mistake. No one will be buying your product.

This is the overpricing problem.

What about pricing it lower than what your customer can actually pay?

Pretty much like selling an iPhone at $599 when people will gladly pay $999 for it.

Sure, in such a case you will be selling all the iPhones that you have. Most probably, you are offshooting all the forecast you ever had thought of.

But at what cost?

At a cost of $400 per phone that you sell. It turns out that you are making a loss of $400 on every iPhone you sell because you can, easily, capture that $400 as well which you are leaving on the table everytime you sell an iPhone at $599.

This is the underpricing problem.

These two are the biggest pricing problems that managers face each day.

But, we started off by trying to understand the disadvantages of cost plus pricing. So why are we discussing all of this?

That’s because, cost plus pricing does nothing to help us in either of these two pricing problems. In fact, you will definitely find yourself in either of these two problems if you go for a cost-plus pricing strategy.

Again, what are the disadvantages of cost plus pricing?

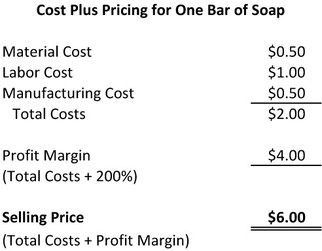

Let’s do a quick recap from the previous article which was on what is cost-plus pricing.

In Cost-plus pricing, you calculate the cost of each piece of product that you produced. On top of that, you add a margin, say 10% or 15%, and sell the product at this marked up price.

But we now know that this pricing strategy is good and applicable for only a few industries or product types. All of that I mentioned in that previous article.

Now, here are the greatest disadvantages of cost plus pricing which make it extremely intuitive for you as a marketer to not use it in your pricing strategy.

1. Cost Plus Pricing Undermines your Value

What if the cost per product is negligible?

Ever wondered what will be the marginal cost of adding a new customer for a SaaS product?

A SaaS product could be a Zoho CRM subscription, about which I talked in one of the previous articles. Or, it could be a Netflix subscription.

How much does it cost Netflix to extend a subscription to you and offer to you all the movies when you join in as a new customer?

That cost is negligible!

All the movies are hosted on the Netflix server already and all it does is create a new user access for you whenever you pay for it for the first time.

Going by cost-plus pricing, Netflix should charge you literally peanuts (or popcorns) for the subscription that you purchase.

But it doesn’t.

It charges you as per the value that Netflix has in your life. As per what you think about Netflix, your perception of its usefulness in your life.

And this is where you need to understand what is value based pricing.

2. Cost Plus Pricing Undermines your Positioning

At the end of the day, you do need to remember that each of the four Ps is just a lever that you pull to fulfill your positioning for your target audience.

In effect, Positioning comes first.

Also Read: The Positioning Formula – What is Positioning? (The Viagra example)

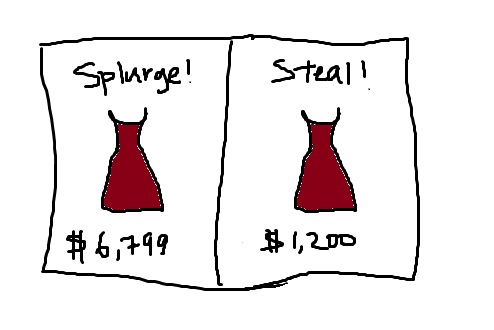

Starbucks makes that coffee for which you pay ₹250 at probably one-tenth of that price. And probably, the company will still remain financially strong if it charged you only half of what it is currently charging you.

But why does it have to charge you so much more than that?

Because there is a positioning it needs to maintain for the people it is serving. For the people it is serving are willing to pay ₹250 per cup of coffee.

And again, it knows what value does a Starbucks coffee have in its customers’ lives. It knows about how does buying from Starbucks makes the customers feel.

Because the fact is, the customers usually don’t care about the cost of making the product. They care about the value the product has in their life.

So the simple question is, why should it leave the money on the table when it can grab it all?

3. Cost Plus Pricing Gives a False Sense of Security

Just what I mentioned at the beginning of this article. Cost Plus Pricing is a drug and it will give you a really dangerous and obviously false sense of security that you are pricing your products correctly.

Where as the reality is that, changing your markup for more profits is not customer centric at all. Maybe you’re marking up too much and therefore, maybe you are losing out on a lot of the customers who could buy if the product was optimally priced.

Or.

Maybe you’re marking up too less and you are losing out on a lot of more money that you could have made.

In reality, cost plus pricing, which never accounts for what the customers think about your products, can never be customer centric.

Also Read: How to Price your Product better in 8 Steps (Part 1 of 2)

4. Cost Plus Pricing Doesn’t Solve the Over- and Underpricing Problems

It is pretty clear from the examples above that using cost-plus pricing you may get a false sense of security. Therefore, you will never realize that the price you have set for the product has put you in a situation of overpricing or underpricing.

People usually do understand why cost-plus pricing may lead to underpricing. But not many understand that how can it lead to overpricing.

Here’s why. If you produce your product for ₹100 and sell it for ₹150, while the market values it only worth ₹80, you are clearly overpricing it.

And what’s the corrective action?

You probably need to work on your operations and get the costs down.

Or maybe just get out of that business.

5. Cost Plus Pricing Doesn’t Keep Your Customers in Mind

This was the most obvious one and therefore I kept it for the last. Also because this point neatly sums up what’s wrong with cost plus pricing.

Here’s the thing.

Any pricing method that doesn’t take into the picture the customers’ is a bad pricing strategy.

And quite simply, that is what makes Value Based Pricing much better than Cost Plus Pricing.

So, your aim as a new product manager has to be to make pricing a completely customer-centric decision. In all other situation, you have pretty fewer chances of success.

Conclusion – What to do?

We discussed how Cost Plus pricing is really quite a drug as it keeps giving you a false sense of security about your pricing. I also highlighted the major disadvantages of cost plus pricing. The reasons as to why cost plus pricing will make you end up in a bad situation in your business.

The solution to this? It is what is called Value Based Pricing.

The idea is to stay away from the disadvantages of cost plus pricing and adopt Value-Based Pricing. This pricing method takes into account the customers’ perspective of the product. And it also happens to be the topic of discussion of my next blog post.

I don’t see why you can’t have a hybrid of cost-plus and value-based pricing.

I own two businesses, one is a cleaning company and the other is owning a rental home portfolio.

In the cleaning business, I am very much value-based. It cost me almost exactly the same to clean your house or business as it does my competitors, but I bring a higher level of quality and a higher level of professionalism. So my value is not based on my cost to arrive and clean your house, but what I personally deliver that others in my field cannot or will not.

Now on the other end of the spectrum I am dealing with builders that are building single family homes for me. They want to charge me a percentage based on the cost of materials as their fee to manage the project. Well this to me doesn’t work, because the amount of work they do is independent of the price of materials. if a box of nails costs 5 dollars and then goes down in price to 3.50, should the builder make less? Did he work less to hammer the same different-priced nails? No!

What if the box of nails increases to 6 dollars? Should I pay the builder more? Did it suddenly get harder to hammer that nail? Is the builder incentivized to find the materials at a cheaper price or a more expensive price?

In this case, a cost-plus model makes more sense by decoupling the labor from the raw materials, allowing for decreases or increases. The value-based pricing would be applied to the labor aspect of the builder. If he’s the best, his cost per square foot should reflect that. That value can increase as the builder gets better at managing subcontractors or increases the complexity of the project.

Hi Jeremy. Thanks for you comment on my article. However, in the second example that you mentioned, with the box of nails – don’t you think still value-based pricing will be better than cost-plus?

Surely, the first situation that you mentioned where in labour cost is a percentage of material cost can severely impact the bottom line. Probably, what you are suggesting is to add a fixed labour cost on top of the box of nails.

Say,

Cost of Nails = $5

Cost of Labour = $10

Total = $15

But, my submission to you is that for you to arrive at that Labour aspect of the cost, you need to think in terms of the value based pricing. How much valuable is my home making service to someone.

Effectively, you will realise that it is no longer cost-plus at all because you are assessing the value of your entire service and the cost of the nails is just a component of it.

Feel free to discuss more on darpan@superheuirstics.com 🙂

Hi Darpan,

Thanks for the reply.

Yes, the labor portion of pricing would be value-based, but the overall cost of the project materials + labor should not be value-based or in the case of the builder I’m working with at the moment, percentage based on the total cost.

It’s short-sighted to not acknowledge that the customer is aware of materials cost (especially in construction). If I contract to build a 1500 square foot home today and it costs 200K dollars, and then say I contract him to build the same exact house on a different piece of land 2 years from now and it now costs 240K dollars, I’m going to be smart enough to know that its the materials and cost of doing business have gone up, not his value. It’s possible that his value has gotten better by 40K, but probably not.

By decoupling the labor from materials pricing he can improve his value to me by sourcing lower-priced materials and actually make more money per job.

Case in point, over the years my cleaning methods have allowed me to go faster and do a better job at the same time. I’m a big believer in Kaizen methodology, continuous improvement. This continuous improvement means that I clean better and clean faster now than 5 years ago.

How does that translate to my value line? Well by increasing my efficiency it allows me to keep my prices steady for longer. My competitors, who are slower and have slimmer margins must increase their prices much more frequently, they customers notice that, they enjoy occasional price increases versus a never-ending stream of price hikes.

In the example you use in the article above you use an iPhone.

Until very recently the cost of an iPhone had not changed much at all in the United States.

an iPhone 9 cost the same as an iPhone 6 did three years before.

How was this possible? Well Apple decoupled the pricing from the materials costs all while building in the value in the profit margin.

Apple then got aggressive at getting those material and manufacturing costs down to keep their value the same and the price steady.

Unless you can fully demonstrate the increase in value you are bringing to the customer, depending on value pricing alone is a mistake.

This is why I believe in the field of building construction Value and Materials should be separated. Think of it as Cost + Value = Price